Following US President Donald Trump’s sweeping tariff initiatives, sentiment towards the US dollar has been mixed with investors accumulating the currency not in response to the punitive duties but as a result of evolving interpretations of their impact on trade and overall market stability.

Trump has agreed to delay the implementation of a 25% additional tariff on imports coming from Mexico and Canada after America’s two largest trading partners and closest neighbours promised to take steps to address his concerns about border security and drug trafficking. Meanwhile, Colombia has agreed to accept deported migrants who had entered the United States illegally after the US leader threatened a range of actions, including steep tariffs, on the South American nation.

His imposition of an additional 10% tariff on imports from China triggered retaliatory measures from Beijing, which Trump sought to play down, saying that he was “in no rush” to talk with Chinese President Xi Jinping.

“As things stand in the enactment of the latest tariffs on Canada and Mexico, Trump’s bite is predominantly a function of his willingness to seal a deal on border security and achieve his policy goal on restraining migration,” says Peter van der Welle, multi-asset strategist at Robeco.

“After Trump abruptly pulled the threat of sweeping tariffs on Colombia earlier last week, after reaching a deal on the return of deported migrants, the market was convinced Trump’s bite would be softer than his bark.”

Initially, there was a notable shift towards the dollar as a safe-haven asset, leading to its appreciation. However, as markets began interpreting the tariff threats more as a negotiating tactic by Trump rather than shifts in US trade policy, the currency declined with the US Dollar Index ( DXY ) falling by 0.9% on Wednesday, reflecting this change in sentiment.

The US dollar had maintained its strength, with the DXY rising to 109.855 on February 2, before declining marginally to 107.672 on February 5. The index rose against a basket of currencies, reflecting the greenback’s strength against other currencies. This appreciation was influenced by the tariff threats and the subsequent announcement of delays in their imposition, as investors assessed their potential impacts on global trade and economic growth.

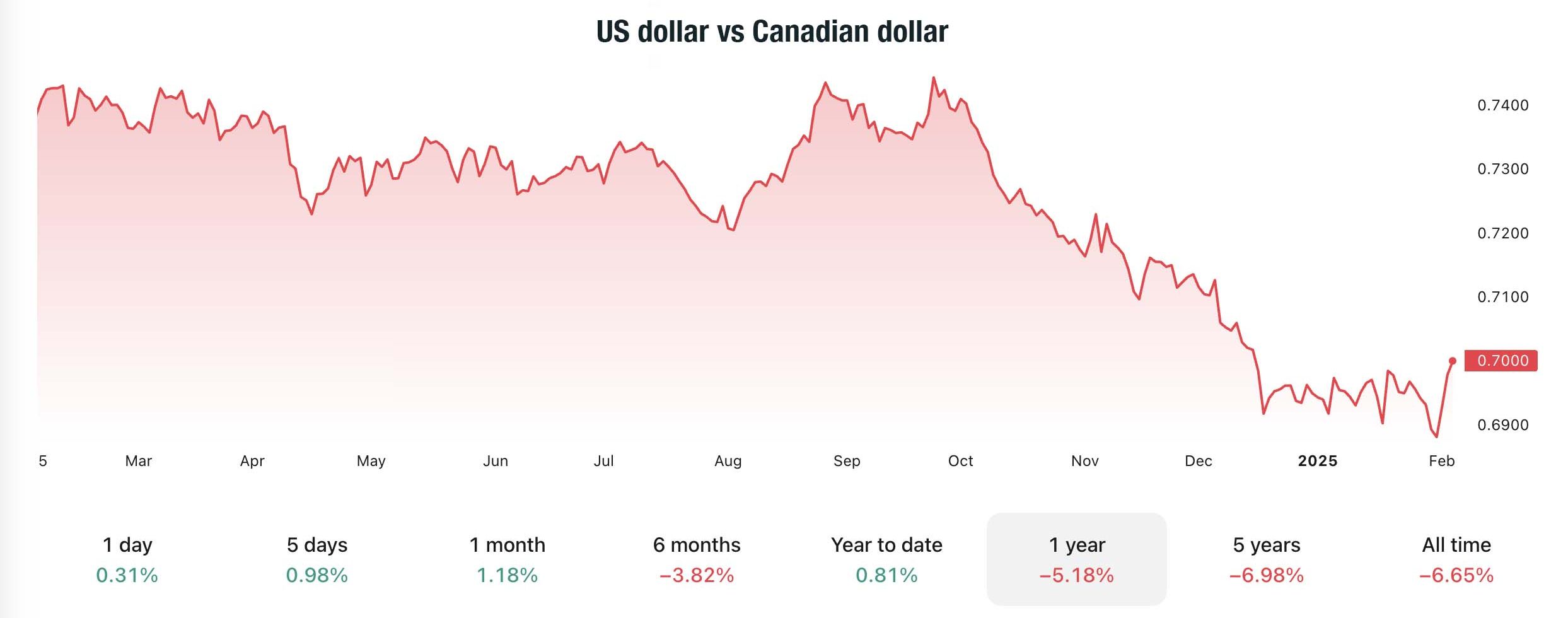

The Canadian dollar has experienced significant fluctuations against the US dollar following the recent tariff announcements, dropping to a 22-year low of C$1.4793 on February 3, which is around 67.6 US cents per Canadian dollar. It recovered slightly to C$1.43 on February 5 but continues to be under pressure in the wake of the ongoing trade tensions and policy uncertainties.

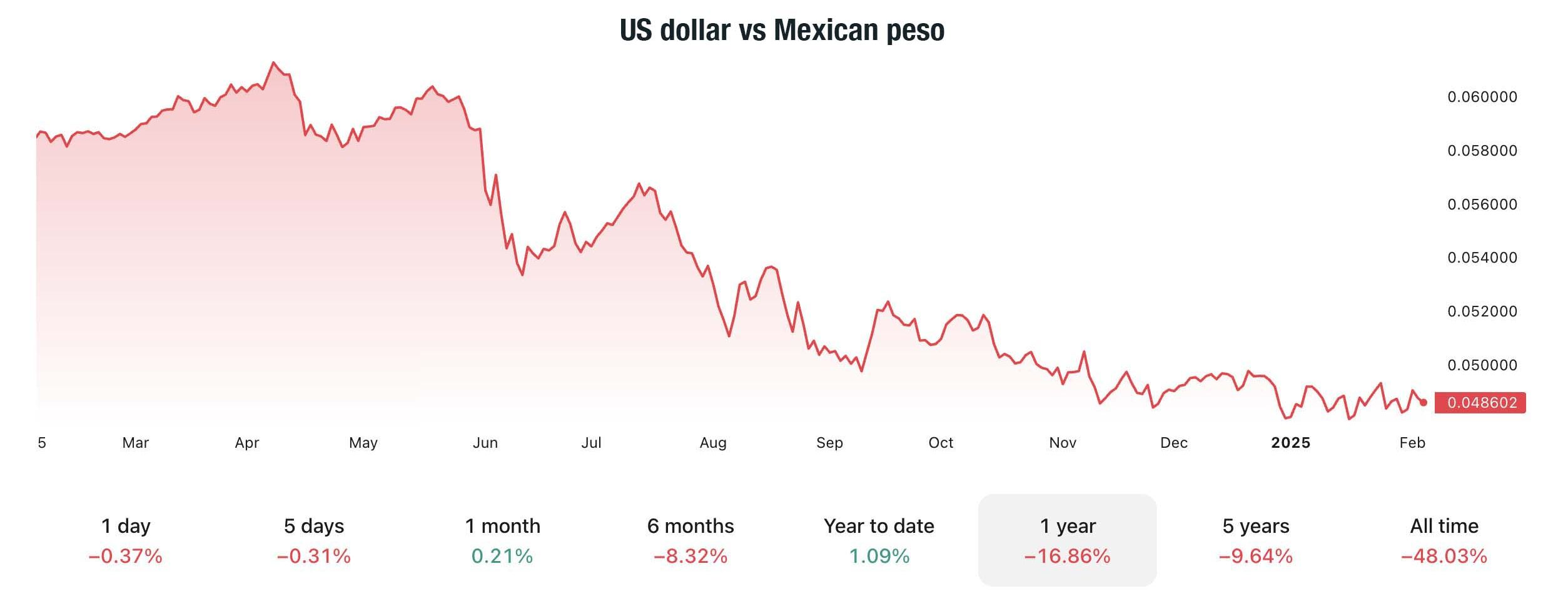

The Mexican peso has also experienced significant volatility against the US dollar in the wake of the tariff threat, plummeting to a three-year low of 21.2882 pesos on February 1, before rebounding by 1.25% to 20.4196 pesos on February 4 following the announcement to delay the imposition of the tariffs by one month.

“One of the more pronounced market transmission channels has been the currency markets, with the Canadian dollar and the Mexican peso both suffering heavy losses against the dollar, but more generally, the tariff announcement has caused a risk aversion shock that has hurt the broader spectrum of risky assets,” comments Benoit Anne, managing director at MFS Investment Management.

Anne explains that in terms of the implications for fixed income, the latest development is likely to further reduce the US Federal Reserve’s policy room to ease interest rates going forward, given the potential one-off adjustment effect on US domestic prices.

“As a result, it is likely that the front-end rates will move higher, thereby triggering some curve flattening. In addition, the cost of energy in the US is likely to go up, which typically tends to be reflected in higher break-even inflation, as a market signal that investors are ready to price in a rise in inflation risk,” he adds.