In an effort to staunch losses and capture opportunities in the bond market, foreign investors in India with a positive sentiment on the country’s growth story have pivoted away from equities.

The beginning of the pivot by foreign investors was clearly demonstrated last October when Indian stocks experienced an outflow of US$11 billion – the worst month of the year – which came after a record inflow of almost US$7 billion in September, data from the Mumbai-based National Securities Depositary show.

This reversal started the Nifty 50’s losing streak, which has led to an almost US$1 trillion loss in equity valuation as of mid-March 2025 compared with September 2024’s high.

Since then, the size of the sizzling Indian bond market has reached US$2.69 trillion, according to data compiled by investment service provider IndiaBonds, with the first three months of 2025 recording US$253 million of accumulated foreign inflow into the debt market, compared with an extended equity outflow of only US$16.6 billion.

Although India has begun a rate cut cycle after holding the key repo rate at 6.5% for two years, the current rate of 6.25% remains appealing. And the move could potentially boost demand for longer-tenor bonds.

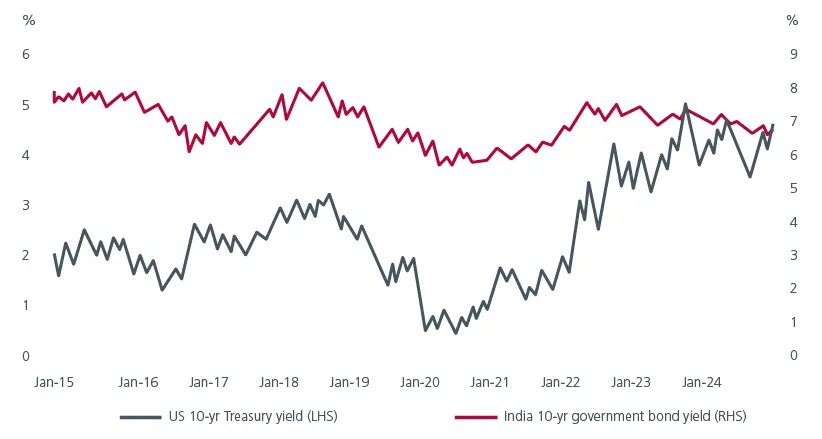

In addition to the relatively high level of yields offered in emerging markets, the stability of Indian government bond yields, notes Eastspring Investments, is also boosting investor confidence.

And the municipal bond market, a recent report by Indian credit rating agency ICRA points out, has seen an estimated 15 billion rupees ( US$180 million ) worth of new issuances during the 2025 financial year.

The emerging appeal of Indian government bonds

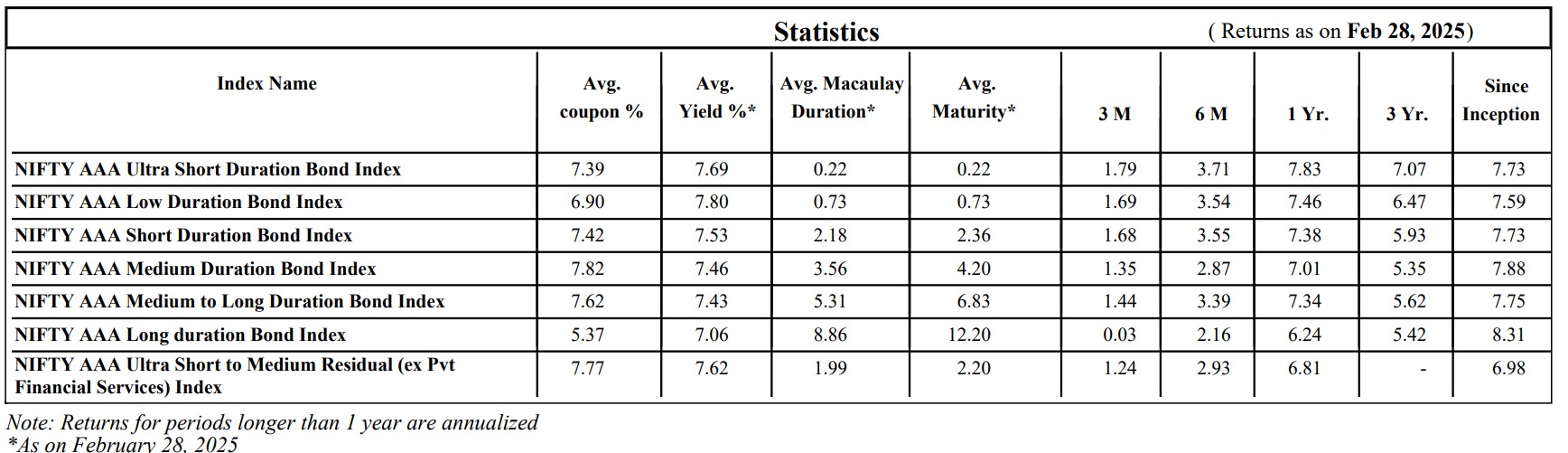

As well, safe choices with high returns are available in the corporate bond space. The average coupon of AAA-rated corporate bonds traded on the National Stock Exchange remains above 7%, offering alternatives to investors with higher risk tolerance.

Nifty 50 index returns

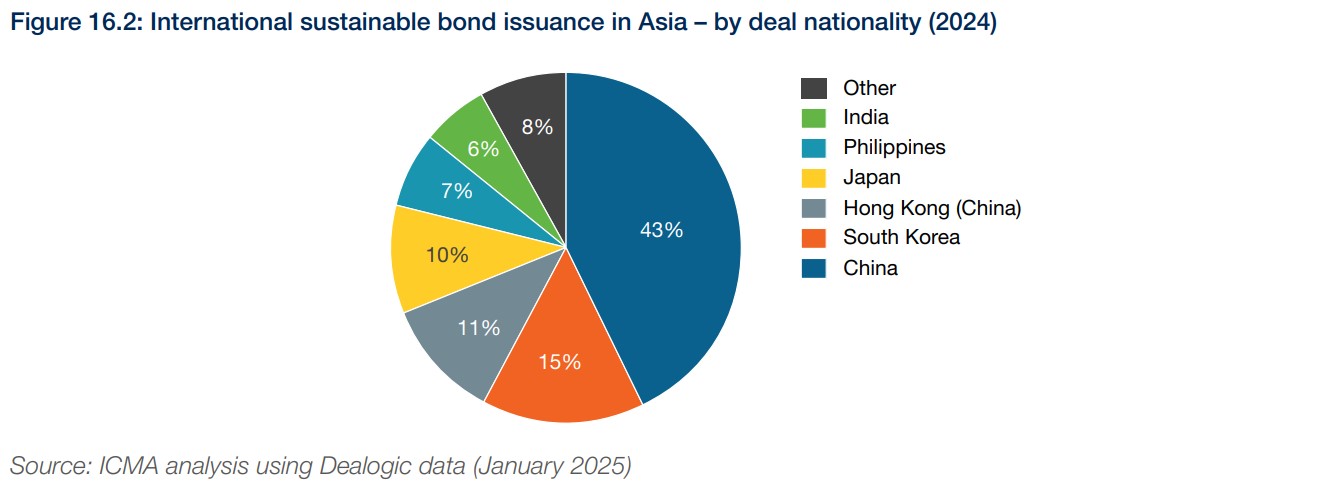

In the corporate space, there has been a constant effort directed at enriching the range of bond offerings. International bond issuance in India jumped by more than half to US$13 billion in 2024 from 2023, a recent report from the International Capital Market Association reveals, with financial issuers forming the substantial part of the market.

And the sustainable bond issuance in India totalled US$5.6 billion last year – sharing 6% of the global issuance – up, as well, by more than half over 2023. The push in sustainable bonds sees investors seeking to tap demand in a space that is increasingly gaining traction in the country.

However, after Indian bond yields remaining stable over recent years, investors need to be aware of the potential risks resulting from the country commencing a monetary easing cycle.

On top of that, a recent announcement by the Reserve Bank of India that it intends to purchase bonds will weigh on yields.