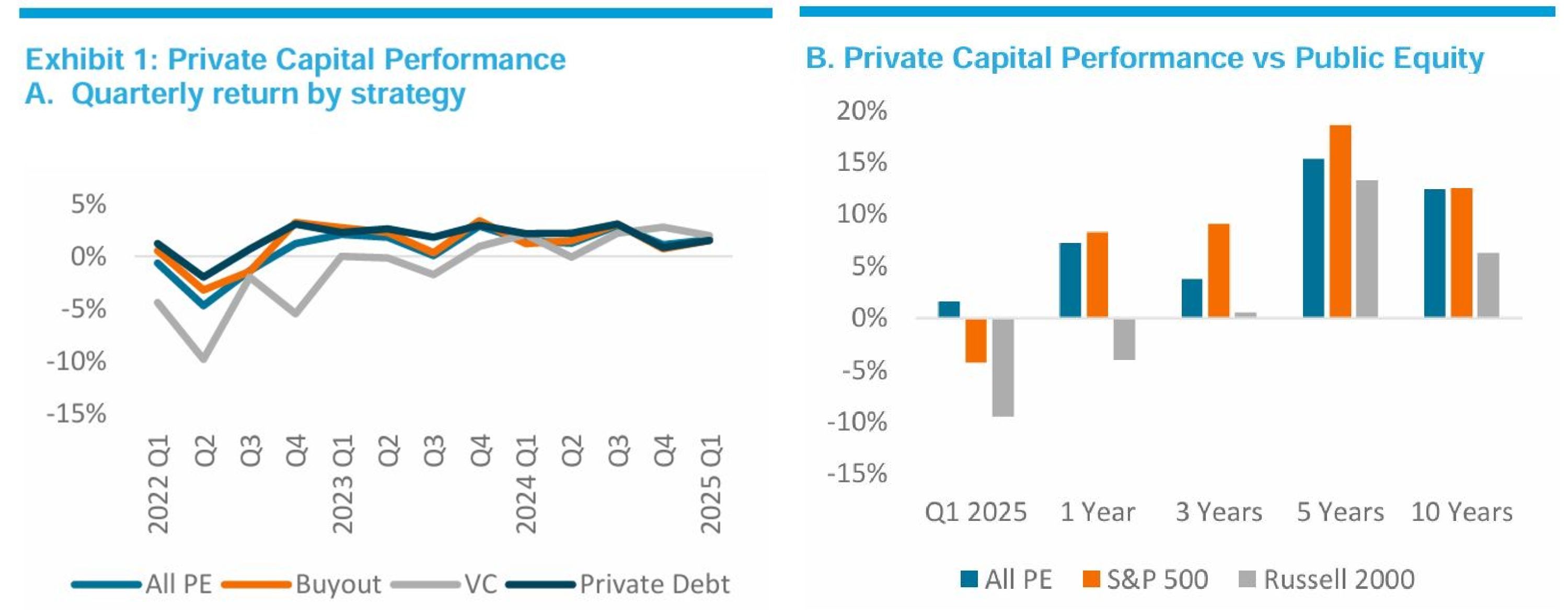

State Street's Private Capital Index ( SSPCI ), which tracks the performance of private equity investments across the firm's limited partner clients, rose 1.60% in the first quarter of 2025, a modest rebound from the 1.09% return in Q4 2024. This mild quarterly acceleration was primarily driven by stronger performance in buyout and private debt strategies, which returned 1.52% and 1.53%, respectively – up from 0.72% and 0.83% in the prior quarter.

In contrast, venture capital ( VC ) lost some momentum with a quarterly return of 1.96%, down from its 2.78% return in the previous quarter, while remaining the top-performing strategy ( See Exhibit 1A ).

Over the trailing one-year period, the SSPCI delivered a 7.23% return, led by private debt with 8.39%, buyout with 7.10%, and VC with 7.09%.

In sharp contrast, public equity markets stumbled in Q1 2025, largely due to the impact of US President Donald Trump’s tariffs implemented since February, State Street says.

The S&P 500 declined 4.27% during the quarter but still posted an 8.25% return over the past year. Small-cap equities, represented by the Russell 2000, fared worse, with a -9.48% Q1 return and a -4.01% decline over the year.

As a result, private capital significantly outperformed public markets during Q1 – particularly small caps – and delivered comparable one-year and ten-year performance relative to large-cap equities ( see Exhibit 1B ).

Source: State Street Data Intelligence, DataStream, as of Q1 2025

Source: State Street Data Intelligence, DataStream, as of Q1 2025

In the first quarter, private capital funds targeting industrials and information technology sectors outperformed, with returns of 2.36% and 1.65%, respectively. Meanwhile, funds targeting healthcare and consumers sectors underperformed, with returns of -0.41% and -0.25%, respectively.

On a one-year basis, most sector-focused funds continued to outshine generalist peers. Specialists in financials ( 11.90% ), industrials ( 10.60% ), energy ( 10.17% ), and information technology ( 7.33% ) all exceeded the 7.01% return generated by generalist funds. This performance gap illustrates the growing importance of sector specialization in today’s competitive and capital-constrained environment.

The impact of tariffs and broader macro uncertainty was also reflected in fundraising activity, which totalled US$78 billion in Q1 2025. At this pace, full-year fundraising is projected at US$312 billion, well below the US$422 billion raised in 2024. While future quarters may alter this forecast, the current trend signals a renewed slowdown in fundraising that had briefly stabilized in late 2024, State Street says.

The average fund size also shrank, from US$2.3 billion for 2024 vintage funds to US$1.9 billion in Q1 2025.

Meanwhile, dry powder – the capital committed but not yet invested – declined by US$83 billion ( approximately 8% year-on-year, which is the largest percentage drop since 2011 ) to US$945 billion across the SSPCI universe. This decrease, accompanied by a slowdown in capital calls, was observed across all major strategies, signalling widespread challenges in fundraising and capital deployment this quarter.