Asian countries have taken a severe hit from the US “reciprocal” tariffs. But even if the duties have led to an immediate decline in trade activities, the resulting supply chain shifts have opened rich opportunities to bolster intra-Asia ties.

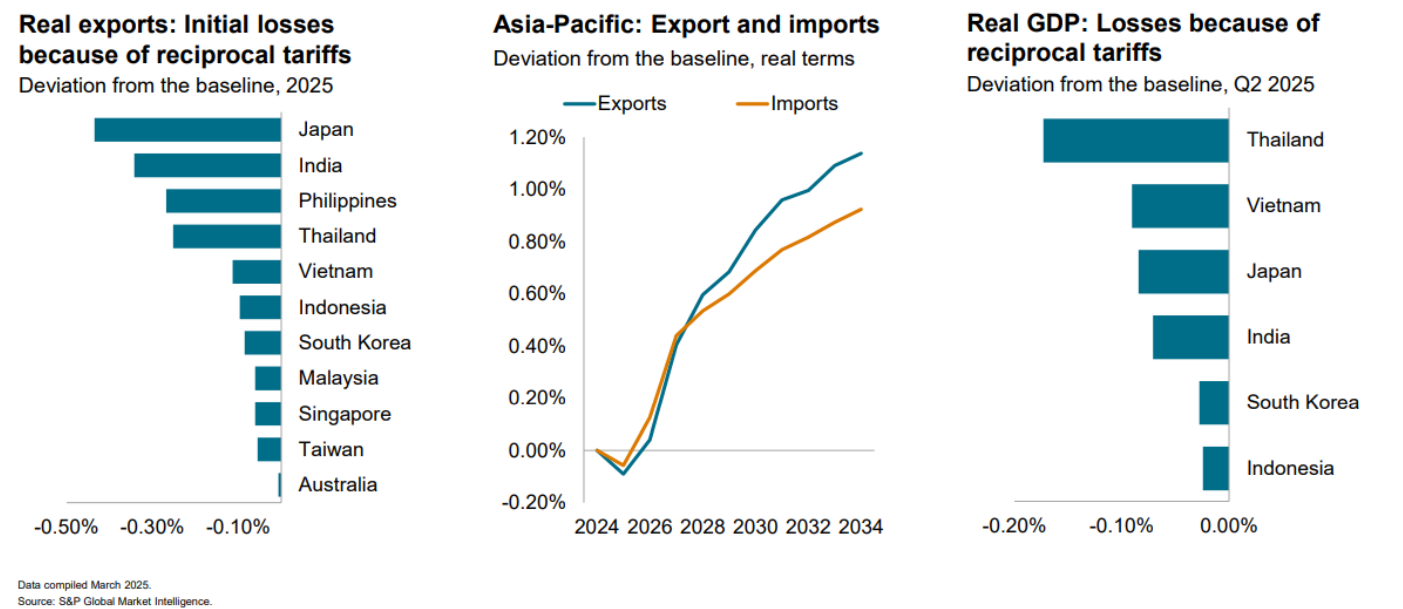

Near-term trade shocks are inevitable as tariffs heighten the cost of exports. Countries such as Japan, India, the Philippines and Thailand are experiencing export dips, with Thailand and Vietnam hurting the most from their overall economic impact.

S&P Global Market Intelligence predicts a 20bp decline in exports across the Asia-Pacific region following a full implementation of the US tariffs.

“The impact of decreasing bilateral trade between the US and the Asia Pacific is offsetting the intra-Asia trade uptick,” says Aries Poon, head of Asia-Pacific Insights and Analysis at S&P Global Market Intelligence.

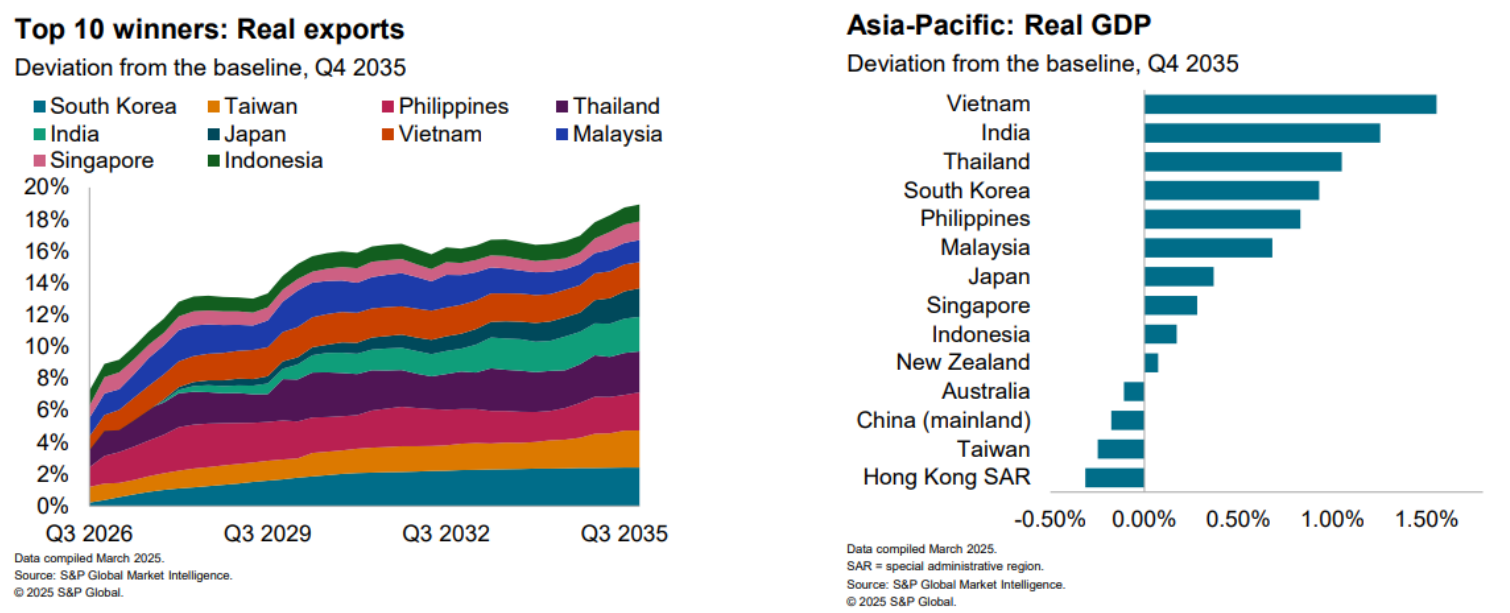

“Yet, in the long term, Asian economies will respond to US tariff policies by further increasing trade within the region, paired with increasing mutual foreign direct investments to support this kind of trade and improve the competitive advantage.”

While it takes at least three years to convert the trade shifts into actual gains, Poon says, emerging Asian economies continue to bolster trade resilience by tapping bilateral and multilateral trade treaties.

In addition to free trade agreements with partners outside Asia, key export hubs are counting on the Regional Comprehensive Economic Partnership ( RCEP ), a free trade agreement that removes tariffs on 90% of goods traded across Asia-Pacific, to further reduce trade barriers with neighbouring markets.

The RCEP will fuel continuous expansion in advanced manufacturing, such as electronics and automotives, Poon states, adding that these high-end products are crucial for Asia to move up the value chain.

Emerging Asian countries, including Vietnam, India and Thailand, are bound to benefit from robust intra-regional trade activities. Competitive advantages shared by these reshoring destinations, such as low labour costs and rapid market expansion, will further propel employment and GDP growth, Poon notes.

“With intra-Asia trades accounting for 60% of the total number of trades in the region, it proves that the Asia-Pacific is not just export markets but also end-markets powered by a growing middle class and consumption power,” Poon says.

“Trade regionalization is more than cushioning the economy against the US trade policy pivot; it’s also the original growth engine for the region.”