While small and medium enterprises ( SMEs ) in Singapore have seen growth amid US tariffs-driven volatility, the sector continues to struggle with financial and operational challenges, according to a new report.

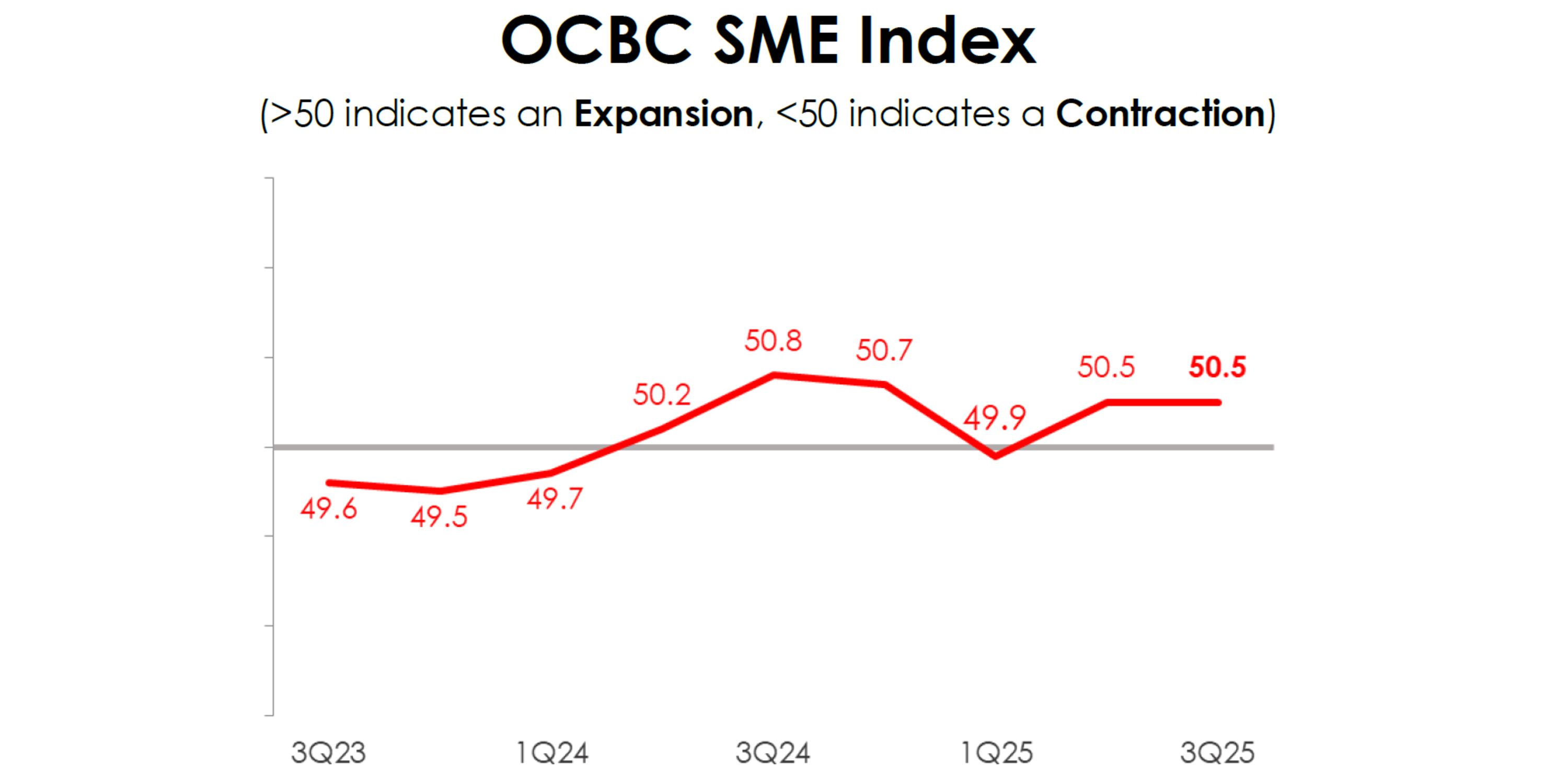

In the third quarter of 2025, the OCBC SME index, which measures the performance of SMEs in the city-state, was unchanged from Q2 at 50.5, indicating steady expansion. Overall collections and payments increased by 8.5% and 6.4% respectively, despite weakened domestic demand.

Record expansion

The ICT ( information and communications technology ) sector reversed 12 quarters of contraction to post a record expansion, led by 30% growth in overseas collections and 21% improvement in overall payments, on the back of robust digital economic activities.

Optimism in the manufacturing segments, including precision engineering, electronics, and semiconductors, as well as consumer products, underpins steady headway in the sector. Trade uncertainties are partially offset by demand cycles, OCBC explains, with the electronics manufacturing subset riding on a technology upcycle.

Along with the robust sectoral performance, however, is the intensifying pressure on expenses and talent shortage. Payroll cost in Q3 was up 5.2% from last year among domestic-facing industries, according to the report, while their externally oriented counterparts saw a 5% growth.

Challenges, including cautious consumer sentiment and moderated tourism growth, are weighing on the retail sector. The F&B industry revisited the contraction area with the index standing at 49.4, the lowest reading in two years, driven by a wave of business closures and softer labour market.

Performance of the building and construction sector dipped, with building-material SMEs as well as investment companies and operators declining the most.

Wage increase

Business services also saw softer demand in consultancy, advertising, and exhibition. Worse still, a staggering wage bill increase of 12% from the last quarter is set to further strain the profitability.

“While a significant share of business owners cite that they have no revenue generated from the US market based on the OCBC Business Outlook poll, SMEs are still exposed to second and third order impact from the US tariffs,” states the report. “As external demand weakens, SMEs, particularly those in the export-oriented industries, may find their margins eroding further.”

In addition to the limited shock absorption capacity, OCBC revised the SME outlook downwards. Meanwhile, SMEs are encouraged to pivot to the frontier sectors of artificial intelligence ( AI ), digital platforms, and software development to capture the structural demand boom for technology-based solutions.

“The coming months are crucial as greater clarity on the impact of the US tariffs will emerge. This would incentivize SMEs to reassess and restructure their supply chains and decide on their next market strategy,” according to the report.