India has emerged as the world’s hottest hub for initial public offerings ( IPOs ), leading the global charts in the sheer number of listings. In the first three quarters of 2025 alone, more than 250 companies went public – a pace that amounts to nearly one new listing every single day. Yet, despite the record-breaking momentum, the real test lies in how these newly listed stocks perform after debuting on the market, with post-listing returns challenging the early wave of investor enthusiasm.

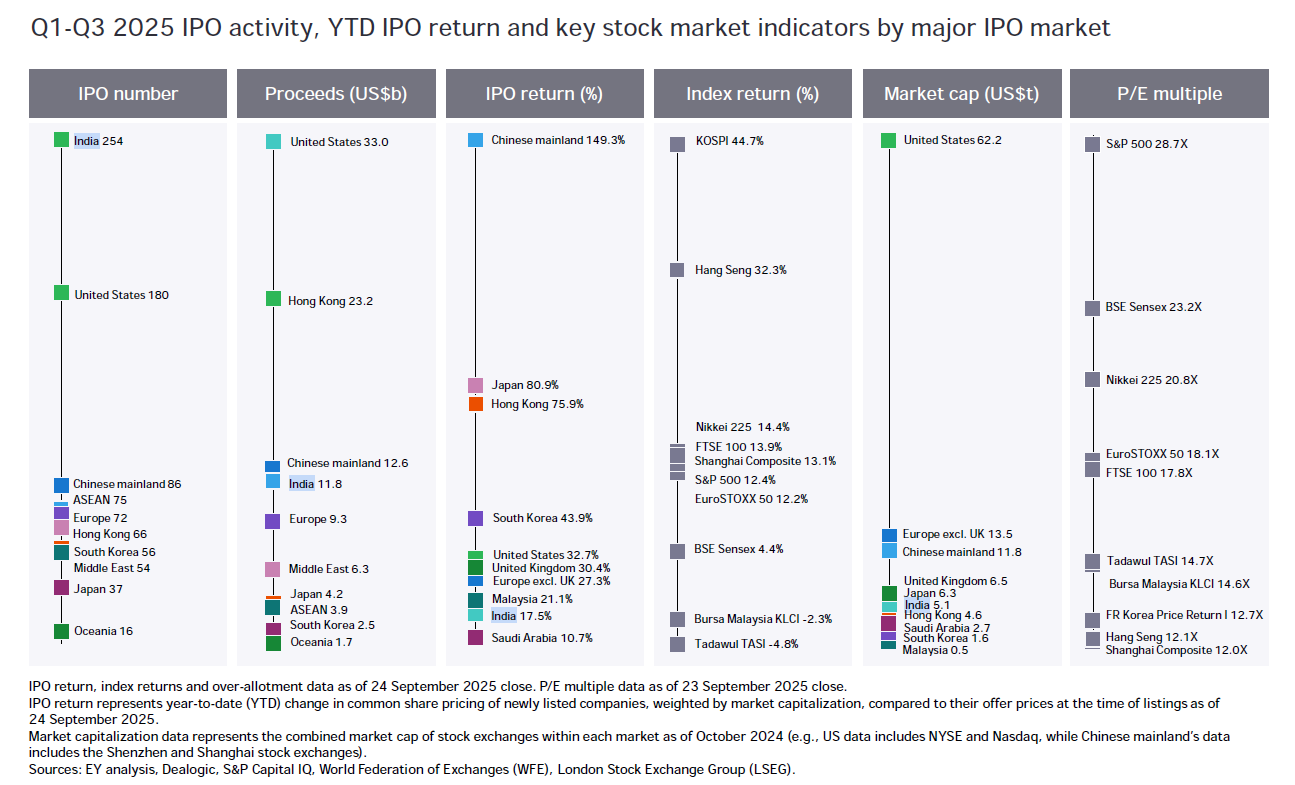

According to Ernst & Young ( EY ), Indian IPOs raised an impressive US$7.2 billion from 146 offerings between July and September. Over the first nine months of the year, the country accounted for 254 IPOs, approximately 30% of all global listings, leaving traditional financial powerhouses such as the United States and China trailing behind.

Below global average

Underpinned by strong valuation multiples, businesses in the fintech, manufacturing, and renewable sectors dominated the Indian IPO deals.

Despite its world-beating volume, however, the market lagged in terms of proceeds, raising a total of US$11.8 billion, which paled in comparison to the amounts raised by the leading IPO markets – the US, US$33 billion; Hong Kong, US$23.2 billion; and mainland China, US$12.6 billion.

Over the nine months, Indian IPOs delivered an average return of 17.5%, well below the global average of 58.3%. In the secondary market, more than a quarter of IPOs over the last 21 months fell below their offering price, according to financial services provider Motilal Oswal.

Of the 10 largest IPOs listed this year, only three have recorded gains year-to-date, while two of them saw double-digit losses, including the US$1.5 billion IPO of HDB Financial Services, one of the country’s largest non-bank financial institutions, which has declined over 10% since its trading debut.

While the IPOs themselves drew a massive investor response in the fiscal year 2025 to March – as suggested by the 102x and 35x oversubscription among institutional and retail investors, respectively – they were followed by widespread selloffs amid concerns over overvaluation.

The mismatch between the listing price and price expectations triggered quick profit-taking, global law firm Nishith Desai explains, particularly when these companies failed to justify their valuations to investors who are increasingly prioritizing fundamentals and transparency.

Speculative interest

“Retail investors have participated enthusiastically,” the law firm says. “However, a large portion of this interest appears speculative, with many investors aiming to book quick listing gains. When these gains don’t materialize, panic sets in and stocks tumble.”

Indeed, the IPO boom has lifted the retail market, but it has also led to investor fatigue for as many as four IPOs from the small and medium enterprise ( SME ) sector have swamped the market each day. In addition to the market’s limited absorptive capacity, sophisticated investors are challenging the IPO pricing, making it difficult for companies to easily raise capital at inflated valuations.

Still, some well-positioned IPOs have maintained their strong footing. Stallion India Fluorochemicals, an industrial gas provider, saw its share price soar over four times, and remains on track for double-digit growth after correction. Ather Energy, an electric scooter manufacturer, doubled its share price in less than six months. Other industrial companies, including Quality Power Electrical Equipments, Belrise Industries, and Jain Resource Recycling, also enjoyed double-digit growth.

Meanwhile, a strong listing pipeline of multinational brands has sustained the overall upbeat sentiment. This includes Fujiyama Power Systems, Capillary Technologies, and Tenneco Clean Air, following the sizeable IPOs of WeWork and LG Electronics. In the case of LG Electronics, its IPO was 54x oversubscribed, and its market capitalization surged to 1.14 trillion rupees ( US$12.85 billion ) on the first trading day, surpassing even that of its parent company traded on the Korea Stock Exchange.

The regulator has also introduced market-boosting measures, easing the barrier for foreign investment and opening market access for sovereign-backed and overseas retail funds. This has been able to reverse the three-month streak of foreign outflows from July to September.

“For 2025 and beyond, the smartest strategy is not chasing every hot IPO, but patiently tracking businesses through their runway, take off, stagnancy, and reversal cycle,” according to the School of Intrinsic Compounding, an Indian investment education and research company. “That’s where true value investing opportunities lie.”