Cryptocurrencies and private equity ( PE ) offer the biggest opportunities for risk-adjusted returns over the next five years, according to a recent study.

Two out of three ( 65% ) institutional investors and wealth managers surveyed include crypto while 61% select PE among their top five asset classes for risk-adjusted returns over the next five years, ahead of 53% who include European equities and commodities respectively in their top five, finds the study by London-based Nickel Digital Asset Management ( Nickel ), a European digital assets hedge fund manager founded by alumni of Bankers Trust, Goldman Sachs and JPMorgan.

The confidence in crypto’s long-term performance, identified by the research with executives at firms in the US, UK, Germany, Switzerland, Singapore, Brazil and the United Arab Emirates, which collectively manage over US$14 trillion in assets, is backed by their own investment plans.

Within three years nearly half ( 47% ) expect to have 3% or more of their organization’s overall assets invested in crypto and digital assets compared with less than one in five ( 18% ) who currently estimate that 3% or more of their organization’s assets are in crypto and digital assets.

Around one in eight ( 13% ) of survey participants estimate 5% or more of their assets will be invested in crypto and digital assets in three years compared with just 6% currently.

Firms questioned rank the 24/7 marketplace in crypto and digital assets and the prospect of better returns than other asset classes as the key benefits of investing in the sector.

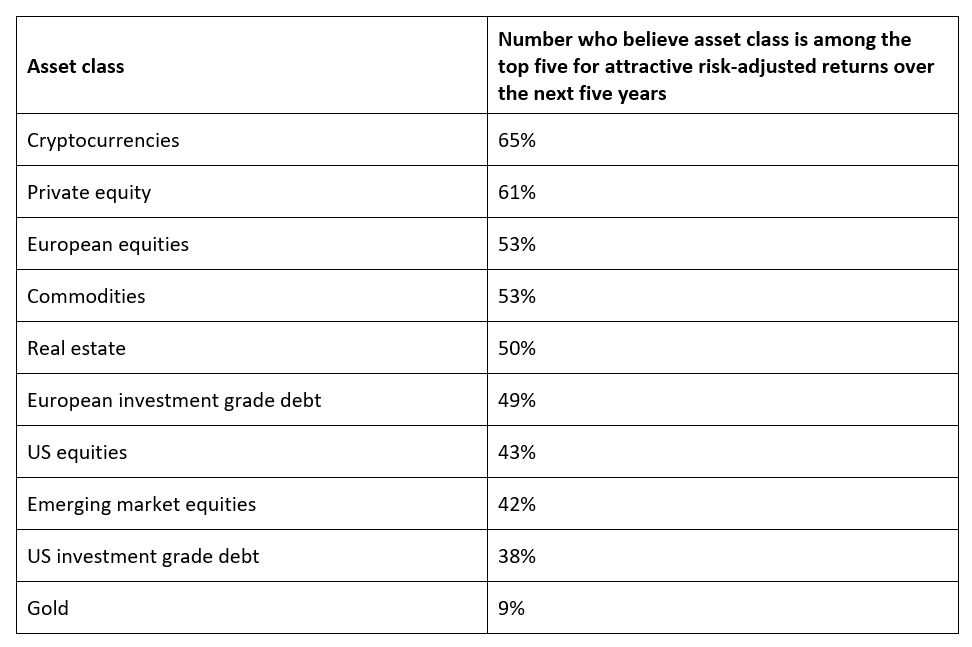

The table below shows how institutional investors and wealth managers rank the asset classes among their top five for risk-adjusted returns over five years.

“Institutional investors are no longer debating whether digital assets belong in portfolios, but how to access them in a controlled, risk-efficient way,” says Nickel Digital’s CEO and founding partner. “Crypto’s evolution mirrors what we’ve seen in private markets, early growth driven by beta, followed by institutionalization and a focus on risk-adjusted returns. The next phase of adoption will be led by strategies that are non-directional, diversified and resilient across market regimes.”